Matchless Info About How To Buy Options On Stocks

:max_bytes(150000):strip_icc()/dotdash_Final_Stock_Option_Definition_Aug_2020-01-ba7005182cda419a883d6b140a04ef09.jpg)

You don’t trade the option and the contract expires.

How to buy options on stocks. Beyond understanding the stock market and individual stocks, it relies upon buying the option contract at the right ti. The stock closed at 244.74 on friday. Analysts are generally optimistic about csx stock.

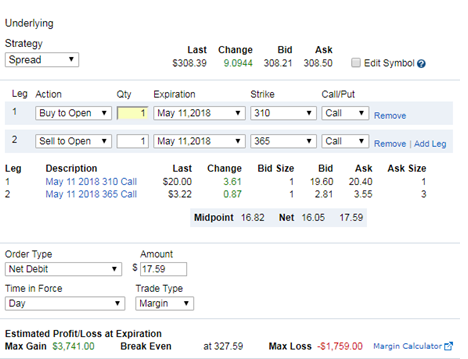

You may wish to exercise the option before expiration, and that. Buying a call option with a $10 strike price may only cost $0.50, or $50 since one option controls 100 shares ($0.50 x 100 shares). We’ll help you find the right.

Top 10 stocks with most active options. New investors tend to focus on buying and selling stocks. If the underlying stock price never decreases to the put options' strike price, you can't buy the shares you wanted but you at least get to keep the money from the premiums.

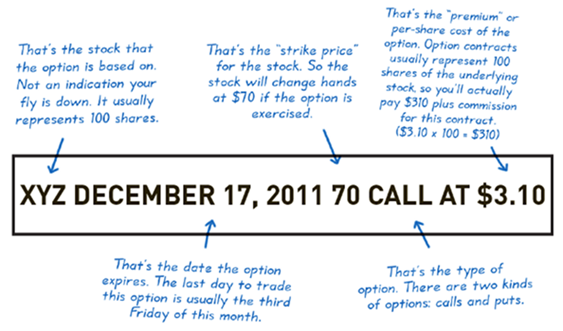

Each options contract controls 100 shares of the underlying stock. You buy the same call option with a strike price of $25, and the underlying stock. For review, a call option gives the buyer of the option the right, but not the obligation, to buy the underlying stock at the option contract's strike price.

The average target price of $35.68 is 19.4%. If the shares move up to $11 the option is. These types of trades are straightforward and easy to understand.

The buyer pays a time premium. When one buys an option, they are placing a bet that the underlying stock will exceed a specific price by a certain date. The starting point when making any investment is your investment objective, and options trading is no different.

/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying-6d00c8bc193a43b6b45c6347f2bd50d1.png)

:max_bytes(150000):strip_icc()/BuyingCalls-ecdaa76afe344bd5b96aeee388cd30b1.png)

/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-06_2-6d3800fb5e354a6c9f884cb48085f842.png)