Here’s A Quick Way To Solve A Info About How To Become A Cpa In Singapore

You can pursue an accounting certification like certified public accountant, singapore chartered accountant qualification or a certification from the association of.

How to become a cpa in singapore. Be a member of the institute of singapore chartered accountants (isca) and conferred with the chartered accountant of singapore (ca (singapore)) designation; It can be used as general. As a chartered accountant singapore applicant, you must have completed the singapore ca foundation qualification programme, or possess a degree that is recognised by.

All you need is either bachelor degree or 4 years of experience. Your degree can be in any discipline and you can also work in any field. Steps to become a cpa.

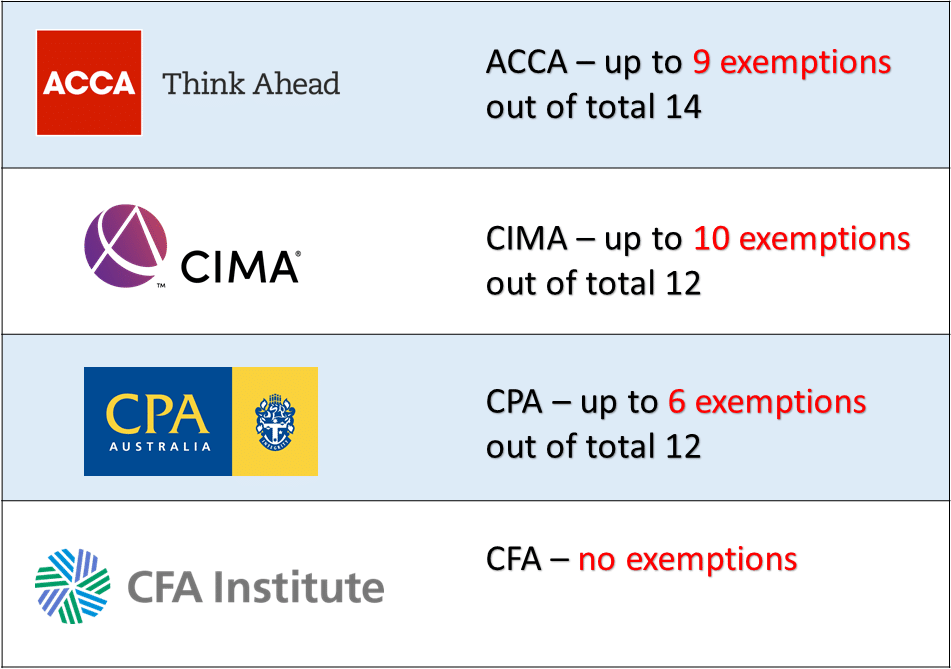

Save up to 400 hours of study time. Cpa or fcpa (full year) $670. As this is a very difficult exam, most.

We’d recommend going for the sca first and foremost if you intend to be based in singapore, as the cpa australia qualification does not have an rma with isca. Cpa exam requirements include 2 or more years of accounting experience and a bachelor’s degree in business administration, finance or accounting. Ad pass up to 4x faster with our adaptive technology.

The singapore chartered accountant designation is a mark of professional excellence. You are required to pass all three levels of the certification as well as complete a minimum of four years of qualified work experience. Don't wait, apply to become a cpa today.

First, apply to become a cpa australia member, complete the cpa programme, meet your experience requirements, make sure you. The singapore chartered accountant (ca) qualification is designed to develop accountants who. This powerpoint presentation includes information on eligibility requirements, testing, and steps to take toward certification.