Outstanding Info About How To Avoid Cgt

In addition to your primary income, you’ll also want to calculate how much you’ve earned from other sources, such as your pension.

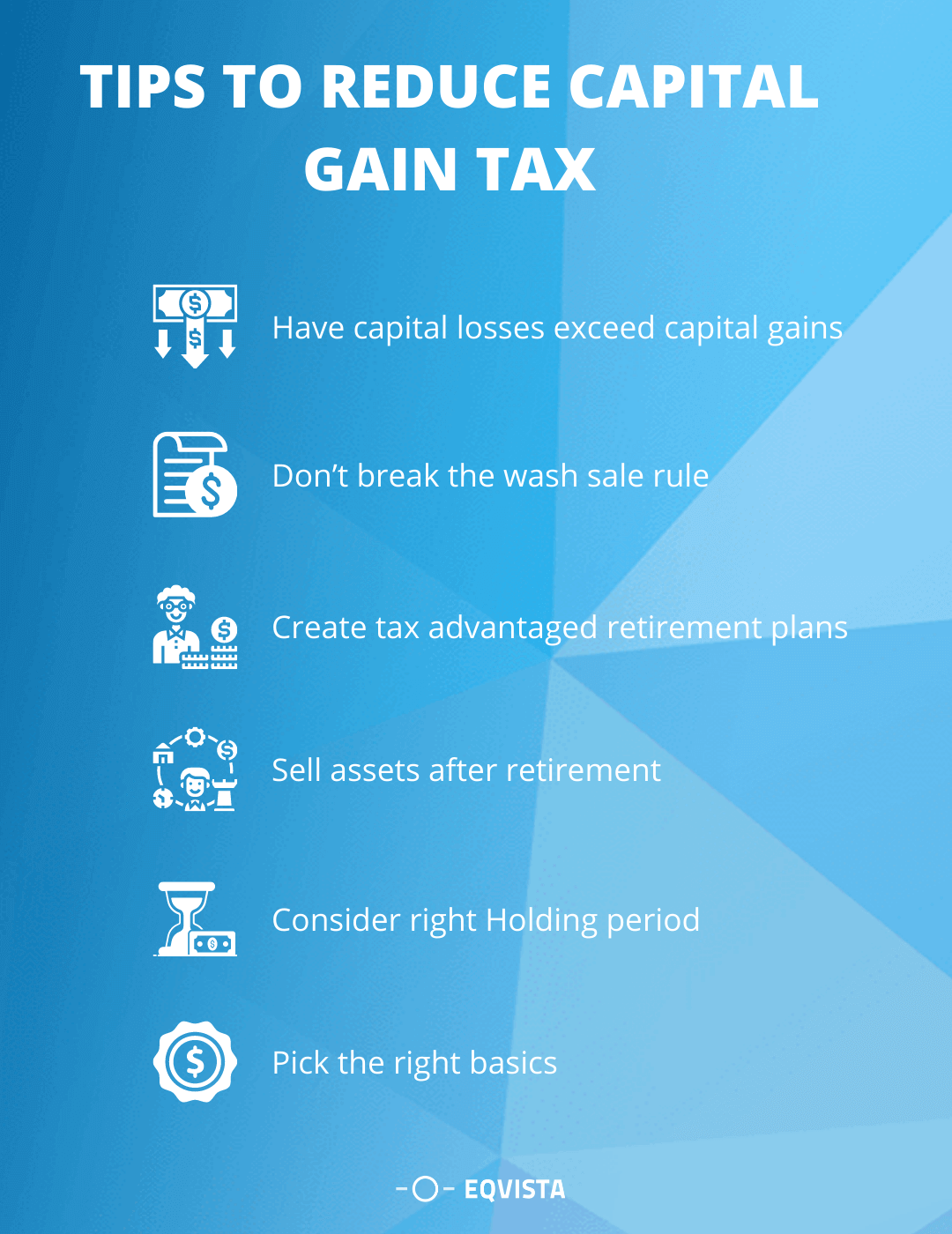

How to avoid cgt. Although cgt is not always completely avoidable, there are some common strategies you can use to minimize the amount of cgt paid on your assets. 9 ways to avoid or minimize capital gains tax (cgt) on commercial investment property in 2021. Investors can realize losses to offset and cancel their gains for a particular year.

If you don’t sell and realize a profit, you won’t be taxed. How do i avoid capital gains tax on shares? If you want to make a profit from the sale of your house, you will owe capital gains taxes.

Can you completely avoid capital gains tax when selling a business? One of the best ways to avoid paying capital gains taxes is to be an individual or a trust because you’ll get access to the capital gains tax general discount. 9 ways to avoid capital gains taxes on stocks.

14 ways to avoid paying capital gains. That means that if you. You would calculate your taxable capital gains as:

That’s “may have to” not “will have to,” because there are several strategies you can use to avoid capital gains tax or at least reduce what you’ll owe. How much will i pay in capital gains tax? Shared ownership everyone has an annual cgt allowance, which is currently £12,300 for the 2022/23.

If you hold a number of different assets, you may be able to offset some of your gains with any applicable losses, allowing you to avoid a portion of your capital gains taxes. However, there are some legal methods to minimize those taxes, such as: Use a roth ira or roth 401 (k).

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)