One Of The Best Tips About How To Apply For A Tax Id Number In Florida

![How To Apply For An Estate Ein Or Tin Online [9-Step Guide]](https://taxattorneydaily.com/wp-content/uploads/2020/06/step1-1024x887.png)

Register for a florida sales tax permit online by filling out and submitting the “florida sales tax application” form.

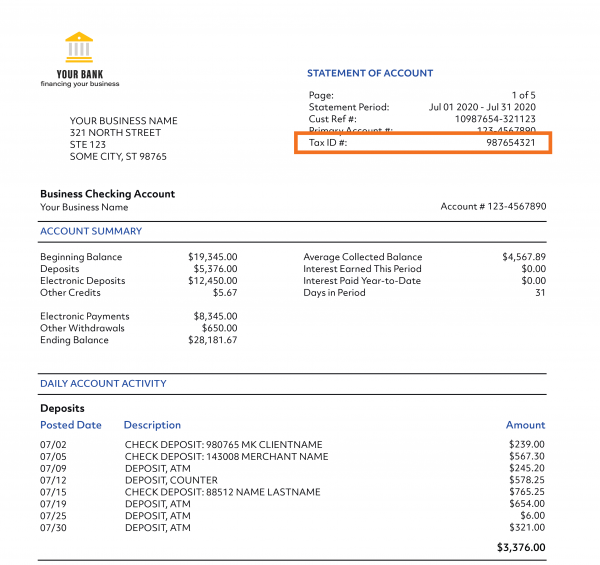

How to apply for a tax id number in florida. The decedent and their estate are separate taxable entities. You might also need an employer. Your state tax id and federal tax id numbers — also known as an employer identification number (ein) — work like a personal social security number, but for your business.

How to apply for a tax id number in florida? The person applying online must have a valid. If you want to apply for an ein on your own and without a fee, you can visit the official irs.

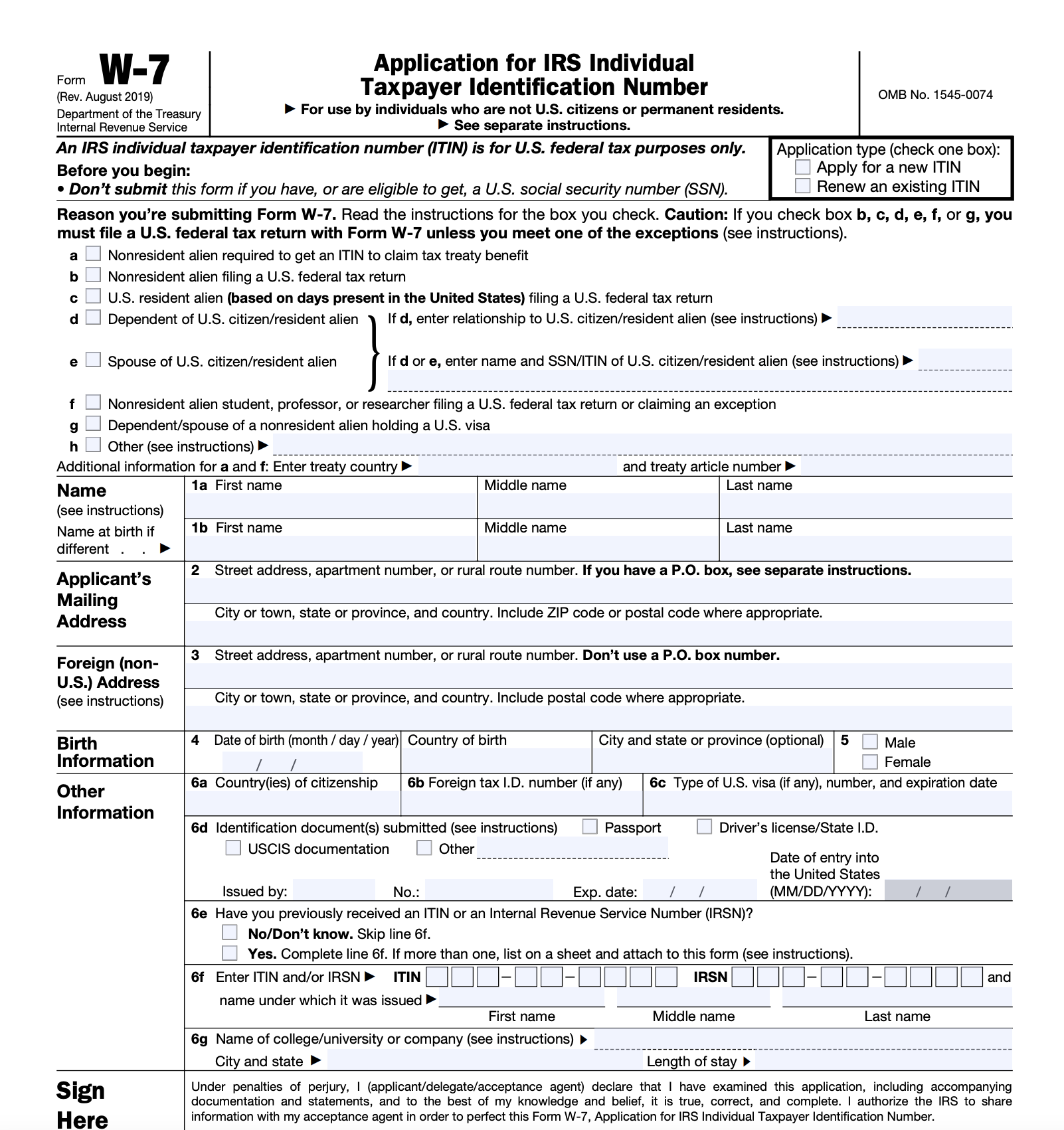

However, it is possible to apply for a federal id in florida without visiting the irs site. To obtain your tax id (ein) in florida start by choosing the legal structure of the entity you wish to get a tax id (ein) for. Yes, estates are required to obtain a tax id:

Obtain your tax id in florida by selecting the appropriate entity or business type from the list below. Once you have all that, you would file your. Apply for a florida tax id (ein) number online to begin your application select the type of organization or entity you are.

Therefore, you can complete the tax exemption certificate form by providing your florida sales tax number. Before filing form 1041, you will need to obtain a tax id number for the estate. Apply for a florida tax id (ein) number.

Reemployment tax is paid by employers and the tax collected is deposited into the unemployment compensation trust fund for the sole purpose of paying. (eastern time) monday through friday to obtain their ein. Once your application has been submitted our agents will begin on your behalf to file.

![How To Apply For An Estate Ein Or Tin Online [9-Step Guide]](https://taxattorneydaily.com/wp-content/uploads/2020/06/step2-1024x925.png)